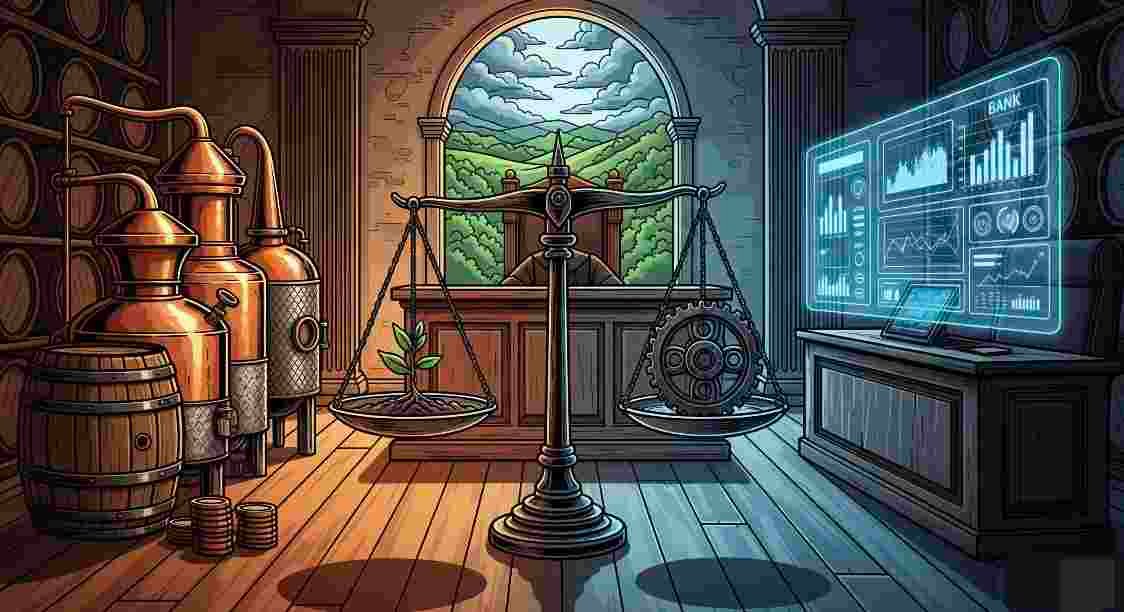

In a state where bourbon is tradition, business is booming, and heritage runs deep, a surprising legal storm is quietly unfolding — one that could shake investor confidence and reshape how financial institutions and distilleries do business together. The Garrard County Distillery Truist Bank lawsuit is more than just a legal dispute — it’s a complex collision of finance, trust, and Kentucky legacy.

As the story develops, many are left wondering: What led to this clash between one of Kentucky’s rising distillery projects and a major financial institution? And what does it mean for the people of Garrard County, a region already staking its future on the success of this bourbon boom?

Let’s explore the facts, the fallout, and the human side of a case that’s beginning to draw national attention.

What Sparked the Garrard County Distillery Truist Bank Lawsuit?

At the center of the Garrard County Distillery Truist Bank lawsuit is a dispute over financial obligations, contractual performance, and allegations of misrepresentation. While the full details are still emerging through court filings and legal briefs, sources close to the case say the trouble began during a key funding phase of the distillery’s expansion.

The distillery — part of a much-anticipated project promising jobs, tourism, and local economic growth — had secured funding from several sources, including Truist Bank. As construction ramped up and millions were poured into equipment, land development, and labor, delays and cost overruns triggered questions from lenders.

Truist Bank, citing concerns about financial transparency and collateral valuations, allegedly halted parts of the funding or initiated demands for repayment. The distillery, in turn, claims the bank acted in bad faith, reneged on agreed terms, and endangered the entire project by withholding funds critical to its completion.

Why This Lawsuit Is Drawing Eyes Beyond Garrard County

On the surface, this might sound like a typical financial dispute — the kind that happens behind closed doors every day. But the Garrard County Distillery Truist Bank lawsuit has caught the public’s attention for several compelling reasons:

1. Bourbon is Big Business

Kentucky’s bourbon industry is worth billions and supports thousands of jobs. New distilleries like this one represent a new wave of craft-focused, locally rooted entrepreneurship — and investors across the country are watching closely.

2. A Small County’s Big Dream

Garrard County isn’t just another dot on the map. For many locals, this distillery symbolized a turning point — a chance to bring tourism dollars, pride, and opportunity back to their community. A legal battle like this threatens more than a business plan; it threatens hope.

3. Banking Accountability in the Spotlight

In the wake of the 2008 financial crisis, and again during the COVID-19 economic turbulence, trust in large banks has been shaky. A case like this puts pressure on institutions like Truist to explain their lending practices and decision-making to the public.

A Human Perspective: More Than Just a Legal Filing

“I got laid off when the pandemic hit. This distillery was my shot at a stable job,” says Devin, a 34-year-old Garrard County resident who was hired as part of the construction crew. “When the funding stopped and everything slowed down, I didn’t just lose a paycheck — I lost momentum in my life.”

Locals also mention the emotional weight of watching a project that was marketed as “by Kentucky, for Kentucky” suddenly entangled in what feels like distant financial politics.

“It’s hard to cheer for progress when you’re stuck watching court dates,” says Linda, a small business owner who was preparing to offer bourbon-themed tours and merchandise before the delays hit.

This is the part of the Garrard County Distillery Truist Bank lawsuit that doesn’t make headlines — the silent impact on people who pinned their livelihoods to a project now trapped in legal limbo.

What Legal Experts Are Saying

Legal analysts familiar with commercial lending contracts say cases like this often hinge on vague language in funding agreements.

“If a bank has too much discretionary power built into a contract, they can pause or pull funding under certain interpretations of risk,” says Madison Wells, a Kentucky-based commercial litigation attorney. “But if the borrower can prove bad faith, or that the bank acted outside the spirit of the agreement, it could be a very different story.”

Early motions in the Garrard County Distillery Truist Bank lawsuit suggest both sides are digging in for a potentially lengthy legal battle — one that may include discovery of internal communications, expert testimony on valuations, and even state-level economic implications.

What Comes Next?

As of now, both parties remain locked in court proceedings. Mediation has been mentioned, but no formal agreement has been announced. The distillery continues limited operations while seeking alternative funding to keep parts of the project alive.

Locals, meanwhile, wait with cautious optimism. Yard signs still read “Proud of Our Bourbon Future,” but some are fading with time and rain.

This lawsuit is more than a clash between bank and borrower. It’s a crossroads moment for Garrard County, for Kentucky bourbon entrepreneurship, and for the financial institutions that say they support rural innovation.

Final Thoughts: A Community Caught in the Crossfire

The Garrard County Distillery Truist Bank lawsuit isn’t just about contracts or courtroom strategy — it’s about the soul of a small town fighting for its economic future.

As bourbon barrels sit aging in quiet warehouses, a legal drama is aging too — and its outcome may define not just who wins this case, but how communities and banks partner in the years ahead.

Because at the end of the day, it’s not just about business. It’s about trust, transparency, and the people left waiting when promises go unfulfilled.